Friday, November 05, 2004

When they say it's not about the money, it's about the money

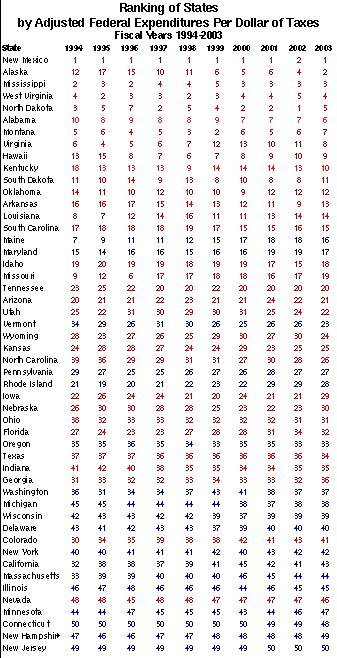

NOTE: The table is sorted by rank in 2003 (the right-most column). Red states, red numbers, blue states, blue numbers. Thus, red New Mexico, in 2003, paid the least in taxes, and gained the most in subsidies.

Source: Tax Foundation, from Census Bureau data.

All taxpayers know that the federal government uses tax and spending policy to redistribute income from citizens with high incomes to those who make little, but citizens are less aware about geographically based income redistribution. Tax Foundation Senior Economist Scott Moody compares the federal tax burden in each state with Census Bureau data (2003) on federal spending in each state. The result is a ranking of which states got the best deal in 2003 from Uncle Sam’s tax and spending policies.

If some states are beneficiaries, then naturally some must be benefactors—those states where so much is collected in federal taxes that any federal spending they receive is overwhelmed.

Combining the third highest tax burden per capita with the ninth lowest federal spending, New Jersey had the lowest federal spending-to-tax ratio (57¢). Other states that had low federal spending-to-tax ratios in FY 2003 are New Hampshire (64¢), Connecticut (65¢), Minnesota (70¢), Nevada (70¢), and Illinois (73¢).

Federal spending on defense and other procurement dollars are often funneled to the states of powerful Members of Congress, and state governments can grab more federal grant money by skillfully manipulating their spending to comply with federal regulations.

However, demography may be more influential than politics. States with more residents on Social Security, Medicare and other large federal entitlements are bound to rank fairly high. Similarly, the high spending levels in Virginia, Maryland and the District of Columbia are explained by the predominance of federal employees.

On the tax side of the equation, states with higher incomes per capita—New Jersey stands out—pay much higher federal taxes per capita because of the income tax’s progressive structure. The citizens in these high-income, high-tax states do not always live better or save more than people in low-income, low-tax states because the cost of living is usually that much higher or more.